If you are a resident or business owner in Missouri City, Texas, you may need to visit the Missouri City tax office for various reasons. Whether it's paying your property taxes, obtaining a business license, or registering your vehicle, the tax office is where you can get it all done. In this post, we will cover everything you need to know about the Missouri City tax office.

The Missouri City tax office is located at:

5855 Sienna Springs WayYou can contact them by phone at (281) 499-1223 or by email at tcollector@missouricitytx.gov.

The Missouri City tax office offers a variety of services to residents and businesses in the area. Some of their most popular services include:

The tax office accepts cash, checks, and credit/debit cards for most transactions. However, there may be some services that require cash or check payments only.

Yes, you can pay your property taxes online through the Missouri City tax office website. You will need your account number and the amount due to make a payment.

You will need to bring your vehicle registration card, proof of insurance, and a valid driver's license or ID card.

The Missouri City tax office is an essential resource for residents and businesses in the area. Whether you need to pay your property taxes or obtain a business license, the tax office can help you get it done efficiently. Make sure to bring all necessary documents and forms of payment when visiting the office.

For more information about the Missouri City tax office and their services, visit their website or contact them directly.

Sales Tax Rate. City of Missouri City - 1.00%; Metropolitan Transit Authority - 1.00%; State of Texas - 6.25%; Total - 8.25% ... HomeDepartmentsFinancial ServicesTax Information Tax Rate per $100 of the Assessed Value: Fort Bend Independent School District *This total tax rate DOES NOT include municipal utility district (MUD) and/or public improvement district (PID) rates as those will vary depending on the location of the property. Metropolitan Transit Authority - 1.00% Tuesday - Friday: 8 am - 4:30 pm Tax Increment Reinvestment Zones (TIRZ) Do I need to have a rental home inspected before renting it out? How do I pay for an Alarm Permit? How do I report illegal dumping? Government Websites by CivicPlus®

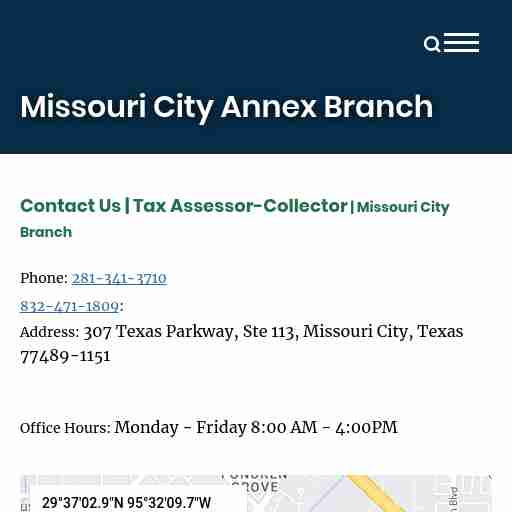

Contact Us | Tax Assessor-Collector | Missouri City Branch ... Address: 307 Texas Parkway, Ste 113, Missouri City, Texas 77489-1151. Office Hours: Monday ... Meet your Tax Assessor-Collector Pay It Forward (Escrow Accounts) Request for Waiver of Penalty & Interest Tax Office Map Clearance Procedures Consumer Information for Manufactured Housing Texas Parks & Wildlife Department (TPWD) Boat Services Contact Us | Tax Assessor-Collector | Missouri City Branch Phone: 281-341-3710 Address: 307 Texas Parkway, Ste 113, Missouri City, Texas 77489-1151 Office Hours: Monday - Friday 8:00 AM - 4:00PM 301 Jackson St Richmond, TX 77469 United States © Fort Bend County, TX. All Rights Reserved

The Department of Revenue's Central Office is located in Jefferson City, but ... Tax Information Office · General. General Information. Human Resources ...---

ARE YOU DELINQUENT ON YOUR PROPERTY TAXES? Texas Homeowner Assistance provides financial assistance to qualified Texas homeowners who have fallen behind on ... Meet your Tax Assessor-Collector Pay It Forward (Escrow Accounts) Request for Waiver of Penalty & Interest Tax Office Map Clearance Procedures Consumer Information for Manufactured Housing Texas Parks & Wildlife Department (TPWD) Boat Services Tax Assessor-Collector | Important Notices In observance of Good Friday, all Fort Bend County Tax Office locations will be closed on Friday, April 7, 2023. We will resume normal business hours on Monday, April 10, 2023. ARE YOU DELINQUENT ON YOUR PROPERTY TAXES? Texas Homeowner Assistance provides financial assistance to qualified Texas homeowners who have fallen behind on their property taxes, mortgage, utility payments, and related expenses. This program gives eligible homeowners grants to cover past due property taxes, property insurance, and past due mortgage payments and/or homeowner/ condo association fees. Of the maximum $65,000 available per household, up to $25,000 can be used for property charge defaults. CLICK HERE FOR MORE INFORMATION OR TO APPLY The Tax Office is now offering appointments to the general public, click on the above icon to schedule your appointment. POST-DATED CHECKS: The Tax Office deposits all checks upon receipt, regardless of the date written on the check. Does Your Vehicle Registration Expire This Month? CONTACT THE TAX OFFICE VIA PHONE: Feel free to call our office at 281-341-3710. Our staff is on hand to answer your auto and property tax questions. CONTACT THE TAX OFFICE VIA EMAIL: We are monitoring the Tax Office email account throughout the day. Email us at FBCTaxInfo@fortbendcountytx.gov with any auto or property tax questions.

The Missouri Department of Revenue administers Missouri's business tax ... The Missouri Department of Revenue has worked with local taxing authorities ...---