SHOP NOW! EM Smith Family Jewelers Open navigation menu. Engagement Rings ... One copy is for you to keep, while the other is for your insurance company. An appraisal is more than just an assessment of monetary value. It’s an important piece of documentation that verifies the worth of your jewelry. At E.M. Smith, your appraisal will be performed by our GIA Graduate Gemologist with over 40 years of experience in appraising fine jewelry. You’ll receive two copies of a detailed description of your jewelry. One copy is for you to keep, while the other is for your insurance company. You’ll also receive a photograph of the piece and a helpful list of questions to ask your insurance company regarding coverage. Make an appointment today for a thorough, expert jewelry appraisal in Chillicothe, Ohio. Refunds within 30 days of purchase. Go to item 1Go to item 2Go to item 3 © 2024 - EM Smith Family Jewelers

Handling and treatment of contaminated dredged material (CDM) from ports and inland waterways – Volumes 1 and 2 on CD-ROM In many countries throughout the world, there are urgent problems concerning the contamination of sediment in canals, navigable inland waterways and ports. New techniques have been developed for the management of contaminated materials (Engler and others 1991). The methods are continuing to be evaluated and improved. Because of the nature and variety of the contamination sources and sediment types to be dredged, the assessment, treatment, and management of contaminated dredged material (CDM) require a variety of techniques. There is no universally developed and available panacea to solve this complex problem. In recognition of this serious problem, during the 27th International Navigation Congress in Osaka, Japan, the Permanent International Association of Navigation Congresses (PIANC 1990) recommended the establishment of a working group to examine all pertinent aspects of the problem of handling and treating contaminated dredged material (CDM) from ports and inland waterways. The Congress concluded the following : In order to handle and treat contaminated dredged material (CDM), the case-by-case approach is more appropriate than a rigid classification system. A working group should be set up to investigate this subject. This working group should be given terms of reference including problem definition and recommendation of practical procedures to establish environmental acceptability of the treatment of CDM.””

Your advisor, your plan, your path forward — take on tomorrow with Merrill. What the first rate cut in years means for investors and other timely insights from the Chief Investment Office. Explore our digital tools and resources. Understand what an advisor can really do for you and what financial decisions they can help with. Are your investing skills ready to rock? Put your knowledge to the test with this short quiz. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset allocation, rebalancing and diversification do not guarantee against risk in broadly declining markets. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. Additional information is available in our Client Relationship Summary. This material does not take into account a client’s particular investment objectives, financial situations, or needs and is not intended as a recommendation, offer, or solicitation for the purchase or sale of any security or investment strategy. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. There are important differences between brokerage and investment advisory services, including the type of advice and assistance provided, the fees charged, and the rights and obligations of the parties. It is important to understand the differences, particularly when determining which service or services to select. For more information about these services and their differences, speak with your Merrill financial advisor.

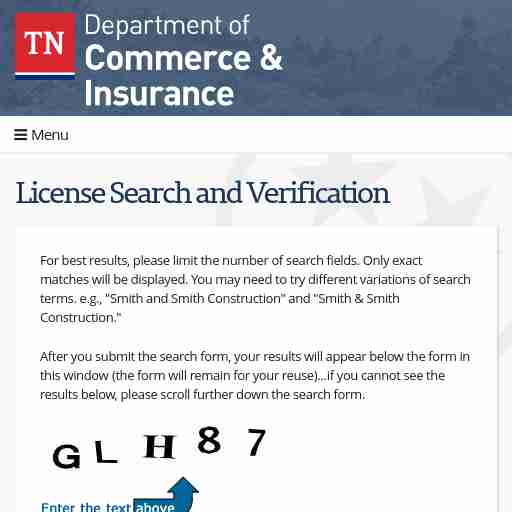

e.g., "Smith and Smith Construction" and "Smith & Smith Construction." If any name has an apostrophe in it, please replace the apostrophe with a percent ... License Search and Verification For best results, please limit the number of search fields. Only exact matches will be displayed. You may need to try different variations of search terms. e.g., "Smith and Smith Construction" and "Smith & Smith Construction." After you submit the search form, your results will appear below the form in this window (the form will remain for your reuse)...if you cannot see the results below, please scroll further down the search form.

Reference #18.3519dd58.1728583910.4c7c693