Jul 15, 2024 ... AAA California Divorce and Bankruptcy Assistance · WELCOME TO AAA California Divorce and Bankruptcy Assistance · Formally known as AAA ... AAA California Divorce and Bankruptcy Assistance WELCOME TO AAA California Divorce and Bankruptcy Assistance Formally known as AAA California Legal Aid Assistance AAA California Divorce and Bankruptcy Assistance has been serving the Surrounding Sacramento area including, Rocklin, Roseville, Citrus Heights, Cameron Park, Granite Bay, Auburn, Folsom and Carmichael since March 1995. We were in same location for more than 25-years and have relocated to McClellan Park, CA by Watt and Madison Avenue and will continue to provide courteous and helpful assistance to our clients. Need help with divorce or bankruptcy in Sacramento? “Divorce”, Child Custody, Child and Spousal Support, Marriage Settlement Agreements and “Bankruptcy”. When you call our office during normal business hours, a live person will actually answer the phone. If you need help in any of the below categories or simply have questions give us a call or email, we do not charge for the phone call and do not push clients into signing or hiring us without your full knowledge of the process and costs. We make every effort possible for you to understand the procedures of the divorce related issues and bankruptcy. We have posted for your convenience the 3-main Credit Reporting Agencies weblink and helpful blog for Reestablishing your Credit. Also you should view your credit report at least once a year. You do not want any surprises when your going to apply for credit and find out there is a problem on your credit report. To view your credit reports go to: annualcreditreport.com.

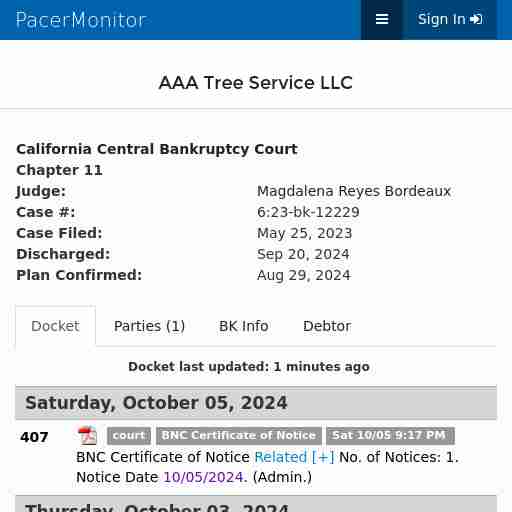

May 25, 2023 ... AAA Tree Service LLC Bankruptcy (6:23-bk-12229), California Central Bankruptcy Court, Filed: 05/25/2023 - PacerMonitor Mobile Federal and ... California Central Bankruptcy Court Judge: Magdalena Reyes Bordeaux Docket last updated: 1 minutes ago 407 court BNC Certificate of Notice Sat 10/05 9:17 PM BNC Certificate of Notice Related [+] No. of Notices: 1. Notice Date 10/05/2024. (Admin.) 406 court Hearing Rescheduled/Continued (Motion) (BK Case - BNC Option) Thu 10/03 12:36 PM Hearing Rescheduled/Continued Related [+] The Hearing date is set for 10/24/2024 at 02:00 PM at Crtrm 303, 3420 Twelfth St., Riverside, CA 92501. The case judge is Magdalena Reyes Bordeaux (SH) court Hearing Rescheduled/Continued (Motion) (BK Case - BNC Option) Thu 10/03 12:39 PM Hearing Rescheduled/Continued (Motion) (BK Case - BNC Option) Related [+] Hearing to be held on 10/24/2024 at 02:00 PM 3420 Twelfth Street Courtroom 303 Riverside, CA 92501 for390 , (SH)

The AAA-ICDR offers a Bankruptcy ADR service offering with mediators who have extensive Chapter 11 industry experience as well as alternative dispute ... Helping Businesses Navigate Chapter 11 Options Both large and small businesses are feeling the effects of the COVID-19 pandemic. Many had to close during this time, and now numerous are being forced to make the painful decision of filing for bankruptcy. The ability of companies to restructure, efficiently liquidate, and/or to sell assets often is contingent upon the expedited resolution of business matters. Moreover, finding out-of-court means to resolve disputes can have a real impact on the efficacy and economy of the bankruptcy process. It is for this reason that Bankruptcy Courts have traditionally embraced the use of mediation in Chapter 11 cases. The anticipated wave of bankruptcy filings may unduly burden the courts, resulting in unnecessary expense and delay while matters await resolution. The use of mediation in the context of Chapter 11 cases can expedite the process by helping debtors and creditors devise agreed-upon—often creative—solutions. Key personnel therefore are freed up and not diverted from their main duties in helping the company restructure. The AAA-ICDR offers a Bankruptcy ADR service offering with mediators who have extensive Chapter 11 industry experience as well as alternative dispute resolution experience resolving complex litigation and corporate disputes. Mediators are former state, federal, and bankruptcy court judges and nationally recognized bankruptcy practitioners. Bankruptcy mediations can be conducted via AAA-ICDR Zoom Virtual Hearing Managed Services. Virtual-hearing specialists attend to all the technical details of the video-hearing process, which is customizable, so that parties and mediators need concentrate only on the mediation procedure.

---

---